Typical payment methods used in modern business, currently in Indonesia, not only by cash, credit or even debit cards, but also with online payment services. Many transactions are transformed into cashless. Sellers and buyers are not necessary to meet each other.

Since three years ago, some of the financial technology or Fintech companies are trying to offer their products for an individual customer in Indonesia. Every fintech companies have to compete with a good promo, like cashback, discounts, or vouchers. Even the effort not directly shows the result, slow but sure the society, especially young generations prefer to make a contactless payment supporting by them.

Now let’s take a look at a survey about what Indonesian people think of payment methods and what they expect to buy with that.

SURVEY PERIOD: August 5, 2017 – December 31, 2017

SURVEY RESPONDENTS: 500 Indonesia, AGED 10-59 YEARS OLD, MEN AND WOMEN

SURVEY DONE BY LICORICE

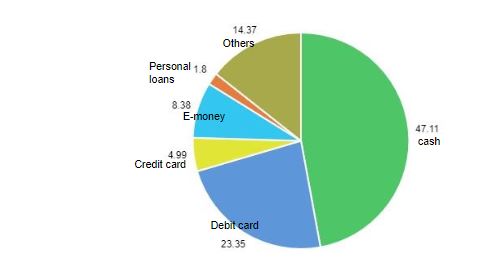

Q: What kind of methods do you often to use when shopping (SA)

When asked about what kind of payment methods, 47.11% respondent or the majority answer said still using cash for shopping or debit card at the second option. But if you pay attention more, the pie chart shows something different when the credit card is not popular than other payments or even Electronic Money (E-Money). These two things are the rising star of payment methods in Indonesia.

As mention above, another payment is what we called fintech. Fintech is a digital transaction or commonly Indonesian people know with their brand names such as OVO, GoPay, Link Aja, or DANA.

What Make Indonesian Love Fintech?

Picture by Energic/Pexels.com

Fintech in Indonesia is growing rapidly. According to Investopedia, Fintech innovation is never stopped developing on financial activities, such as money transfers, depositing a check with a smartphone, bypassing a bank branch to apply for credit, raising money for a business startup, or managing your investments, generally without the assistance of a person.

Fintech is Cashless Platform

According to the CNBC report, users only need a smartphone with a fintech application. They will do many things if they want to donate money for campaigns or financial aid. KitaBisa, one of the famous Indonesian fintech donate aid companies, provides it. Another way, if you want to transfer your money to someone, fintech can help it, by OVO or Dana.

Why You Have to Make An Investment on Fintech?

Picture by Skitterphoto/Pexels.com

Since this business model is running faster than a conventional one, the investor should open their attention. One of the reasons is the market.

According to the CNBC report, consumers are adopting fintech are really fast. They automatically know how to operate the apps with all those features inside. After the market, still refer to the consumer, CNBC said one out of every three people across 20 major economies report using at least two fintech services which operate by smartphone, because all you need to take in and out an insurance or even a loan is only by your hands.

For Indonesian, there are some fintech big companies such as Gojek, GRAB, OVO, Tokopedia, DANA, and BukaLapak are mandatory apps to make life easier.

Last but not least, according to the Indonesian market, these new digital technologies have also embraced the lenders, insurers, and asset managers. So the user for a fintech platform is wider not only for individuals but also for companies.

Fintech Has A Risk

Picture by Skitterphoto/Pexels.com

No one of the business models is with zero risks. Including Fintech, it also has the same condition. For example, Peer to peer or P2P lending, one of the business models in fintech, is allowed an individual to borrow and lend some money without bank procedures. In Indonesia, one of the famous P2P lending called Kredivo.

Kredivo has promo with lend money until Rp 30 million since the first registration. You only need to fill data-id and Kredivo will lend their money. But this business model has risk high risk, how if the borrowers default on their loans? this is the difficulty for the P2P company. So, the investor should pay attention seriously to this and check the agreement clearly.

Another risk for P2P business models are data privacy. We know that cyber-attacks become a bigger threat in the digital world. Fintech as an online service of finance with networks around the world is susceptible to hijack by the hacker. So it may a big concern too.

To sum up, Indonesia may have a good market for fintech industries in the future. Currently, it still developing and running slow but sure. In the future, with more than 260 million people and a demographic bonus in 2030, the society of young and productive people is wider than ever. So investment in fintech industries in Indonesia would be a good point. According to Accenture Global Research in 2018, global investment in the fintech sector has added up to nearly USD 100 billion since 2010. The trend is rising, in 2017 fintech investment surged 18% than 2016, from USD 23.3 b tp USD 27,4 b.

Would be nice to try?

The detailed report which this article referred to is available.

[Table of contents]

- Where is the place Indonesian pay with debit card

- What type of Indonesian credit card

- Please tell what things Indonesian want to buy using a personal

What kind of methods of Indonesian often to use when shopping - If you want to buy a smartphone, a car or motorcycle, or any fancy things, what payment methods Indonesian use

- Summary

No comments yet.